RELATED: GE Aviation, CFM go center stage in Paris

West Chester Twp.-based CFM values the agreement at more than $2.9 billion.

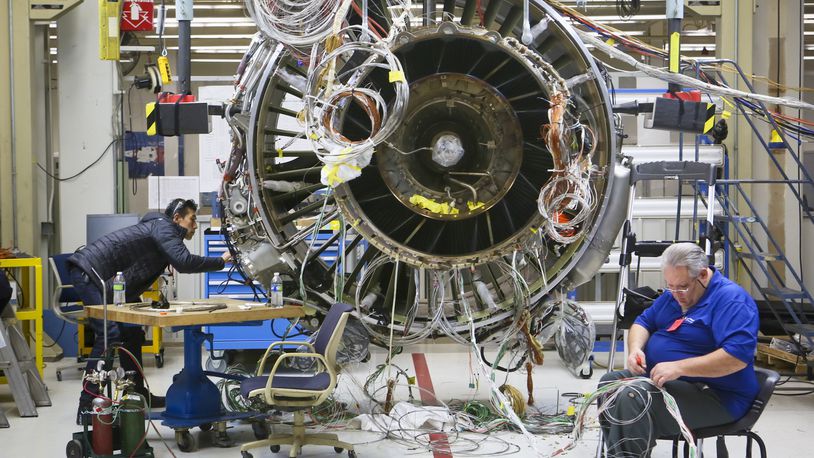

The LEAP engine is a product of CFM International, a 50-50 joint venture between GE and Safran Aircraft Engines. This engine has experienced what GE calls “the fastest order ramp-up in commercial aviation history,” with CFM receiving orders for more than 12,500 LEAP engines through May 2017.

Also Monday, CDB Aviation Lease Finance, a subsidiary of CDB Leasing, announced an order for LEAP-1B engines to power 42 Boeing 737 MAX 8 and four Boeing 737 MAX 10 aircraft.

That order is valued at more than $1.3 billion. Delivery of the engines will begin in 2021.

Also announced from France on Monday: China Eastern selected GE’s GEnx-1B engine to power its 15 new Boeing 787-9 Dreamliner aircraft. The engine order is valued at more than $850 million. Delivery of these aircraft will begin in 2018, GE said.

The aircraft order was announced last year.

Saj Ahmad, chief analyst for StrategicAeroResearch.com, said GE and CFM are off to a strong start.

“GE and CFM have led the aero-engine industry for many years and it’s no surprise that GE leads on the 787, has a monopoly on 777X, while CFM enjoys 100 percent of 737 MAX orders while also leading the orders on the rival A320neo family,” he said in an email.

The General Electric Co. is Ohio’s largest manufacturing employer, with more than 15,000 employees. In Southwest Ohio, where its aviation unit is headquartered, GE anchors an aerospace parts manufacturing industry that employs thousands.

About the Author