The public likely will not find out until the end of the year if the arcade revitalization project will move forward, because that’s when the closing could happen if the final pieces of financing can be secured, officials said.

RELATED: Dayton Arcade wins $5M in state tax credits

Financing and plans for the current redevelopment effort has made far more progress than many of its predecessors, and developers’ ambitious revitalization plans has turned some skeptics into believers.

“I was at the point where I said, ‘Why don’t you just reinforce the facade on Third Street, blow everything else out and start over again and just leave the facade,” said Dayton Plan Board Member Greg Scott. “What I listened to on that panel (discussing the arcade proposal) was the first time I’ve heard anything that I truly believe, based on my experience on this body, that can work.”

Eleven weeks ago, the Dayton Arcade was awarded $5 million in state historic tax credits to support a $70 million to $80 million plan to rehab large parts of the complex.

MORE: How did your school perform on the 2016-17 state report card?

An overhaul of the entire complex — consisting of eight interconnected buildings — would take place in multiple stages.

The development partners on the project — Cross Street Partners and Miller-Valentine Group — won more than $20 million in low-income housing tax credits in June 2016 and other funding support since then.

But the development group is applying for $5 million in additional historic tax credits in the state’s fall funding round and should learn within the next 15 weeks if it is selected.

RELATED: Arcade could boost downtown restaurant scene

In support of the tax credit request, the Dayton City Commission on Wednesday approved a 50-year lease agreement with a limited liability company controlled by the development partners for a piece of the arcade called the Gibbons Annex.

Developers need to be in control of a property to maximize the points on the scorecard the state uses to determine funding awards, officials said.

The tax credits are critical to the developers’ financing package to bring the project to a closing, said Dayton City Manager Shelley Dickstein.

“Everyone is shooting for year’s end,” she said.

TRENDING: 2 days without overdoses in Dayton: ‘A nice break from the death’

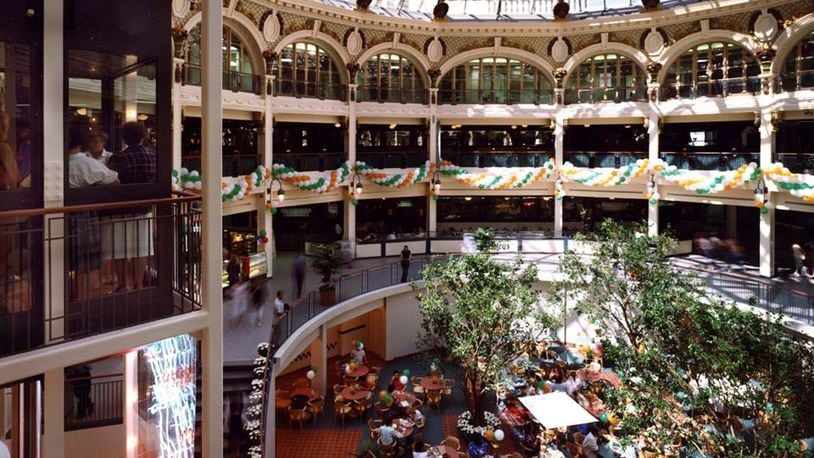

Daytonians have waited for about 26 years for a breakthrough moment for the arcade, which closed in 1991.

They will have to wait a little longer to know if the arcade’s revitalization will become a reality, because huge and complex projects like this take time and lots of work, officials said.

The project actually is moving ahead at a record speed for a project of this complexity, said Dave Williams, vice president of urban development with Miller-Valentine Group

“It’s the money, it’s the planning, it’s the budgeting, it’s the design,” Williams said. “Think about the design alone: Designing 400,000 square feet doesn’t happen over night, and you don’t have a budget until you have a design, and you don’t get money until the budget is all done.”

RELATED: What to know about living in the Dayton Arcade

A historic tax credit gives a property developer a discount on upcoming taxes for the amount of their award in return for investing that much money redeveloping a property considered by the state as having historic value.

About the Author