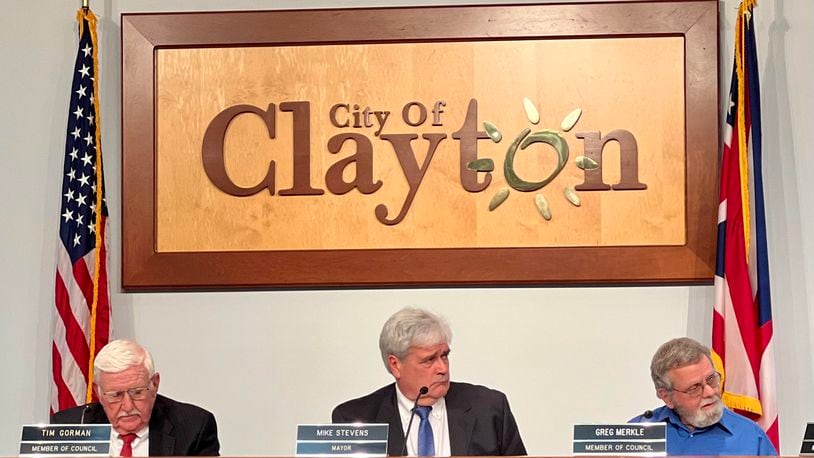

Thursday’s council vote passed 5-2, with Councilmen Kenny Henning and Greg Merkle voting against the ballot measure.

“I’m not in favor of the income tax going back on (the ballot) after it just failed pretty soundly,” Henning said, highlighting circumstances of the March primary that he believes would hinder the levy’s passage. “There’s potentially only going to be a competitive Republican primary, with one party showing up to the polls ... I don’t think it’s going to pass.”

The city’s current income tax rate of 1.5% brings in $5.4 million annually, according to City Manager Amanda Zimmerlin. This revenue total would increase to a projected $7.9 million if the tax rate increase is approved.

Zimmerlin said previously the rate increase is needed to continue providing basic services to residents during a time when costs have risen across the board.

“Like challenges faced by other municipalities, expenses have been increasing across all departments and have now begun to outpace revenue,” she said prior to the Nov. 7 election. “This has led city council and administration to make tough budgetary decisions which may impact those vital services, including police, fire, public service, and administrative departments.”

City staff in each department are finalizing 2024 budgets, with a workshop meeting scheduled for Dec. 7 and a vote on the finalized 2024 city budget set for Dec. 18. Department budget proposals will exclude all non-essential services, Zimmerlin said.

“We started with the Capital Improvement Plan budget because it gets one-third of the income taxes now, and the goal was to reduce all transfers going into the CIP,” she said, adding that these cuts will total around $1.3 million in reductions. Zimmerlin listed several other staff and program cuts that are possible.

How the complicated levy works

Council discussed plans to help voters be well-educated about the tax levy and why it is needed, as some residents in attendance Thursday said the ballot measure language was a bit confusing.

If the measure passes, any Clayton resident working in a municipality with a local income tax rate of 1.5% or higher, such as Englewood, Trotwood, Dayton, Brookville, Huber Heights or Kettering, will see their overall tax bill to cities decrease, according to city officials and Dayton Daily News analysis.

If the measure passes, people who live in Clayton and also work within the city of Clayton, or live in Clayton and work in any jurisdiction without income tax, such as a township, will see their local tax bill increase.

Clayton residents currently get a 50% credit on their 1.5% Clayton city income taxes if they’re paying local taxes to another city. So according to the city, a family with $80,000 in taxable income would owe $1,200 in Clayton tax (1.5%), but would be credited half that amount and only have to pay the city $600 (on top of what they pay the city where they work).

If approved, the Nov. 7 ballot measure would change that to a 100% credit for taxes paid by Clayton residents to other municipalities. Meanwhile, the city would see increased tax collections from people who work in Clayton but live outside the city, as their rate would simply increase from 1.5% to 2.5%.

Vote on housing proposal

Also set to appear on the March 2024 ballot for Clayton voters is a referendum allowing the electorate to have the final say on whether a plan to develop 125 single-family homes on a 43-acre parcel of land at the southeast corner of Phillipsburg-Union Road and Haber Road can move forward.

The Arbor Homes project has been a hot-button topic in the community since its proposal in March, with dozens of residents voicing concern during multiple council meetings.

In response to council voting last summer to approve a rezoning request and development plan for the project, a group of residents created a grassroots campaign, with the slogan “Keep it Rural,” successfully gathering nearly double the required amount of signatures to qualify the referendum for the ballot.

About the Author